What’s a Good Salary? Determining a Salary That Fits Your Life

How much is a “good” salary?

We wish that we could provide you with a magic number here, but it’s probably no surprise that the answer to this question is almost entirely subjective. We say “almost” because there are, of course, salaries that just aren’t enough to reasonably get by.

A “good” salary depends on a lot of different factors:

These factors include your role, industry, location, education level, lifestyle, family size, lodging, and more.

Plus, there are non-salary benefits that you might need to take into account when calculating what a good salary is for you.

Sound complicated? Well, it sort of is. But it’s also really important to understand what salary you need and what salary you want.

This way, you’ll be prepared when negotiating numbers, creating a budget, and deciding whether or not you can afford to take that three-week beach vacation.

To that end, we’re breaking down what a good salary looks like and how to determine what that “magic” number is for you.

What Is Important to You? How Salary Relates to 4 Core Areas of Your Life

We all have different priorities, so it’s obvious that while one salary might be ideal for one person, it might not be enough to suit the desires of someone else.

That’s why it’s important to have an idea of your financial priorities when you’re determining the salary that’s right for you.

For example, are you working on paying down a load of student loan debt? Are you hoping to save for a down payment on a home? Are you simply looking to enjoy your early twenties without considering major purchases? We all have different values, and they change as we age, so we recommend listing your financial goals.

1. Industry

Some average salary numbers can help you determine where you stand in relation to other people in the United States. According to the U.S. Bureau of Labor Statistics, the national median income for all occupations in 2021 was $58,260.

They helpfully list out occupations by the industry as well, so you can take a look at your specific one on this list. If you peruse that list for even a moment, you’ll notice that certain industries and occupations pay significantly more than others. If a what you consider a “good” salary is one that allows you to make six figures, take a look at high-paying roles.

The Census Bureau Report from 2020 showed the national average household income as $67,521.

Pew takes the Census data and provides this calculator to see if you fall in the middle-class range. They note to be considered “middle class,” you need to earn roughly $46,000.

We also love our Salary Project database, which takes real salary information submitted by our readers. You can anonymously enter in your salary, and then you can peruse what others in your role are making. It’s a super helpful tool for getting some salary context.

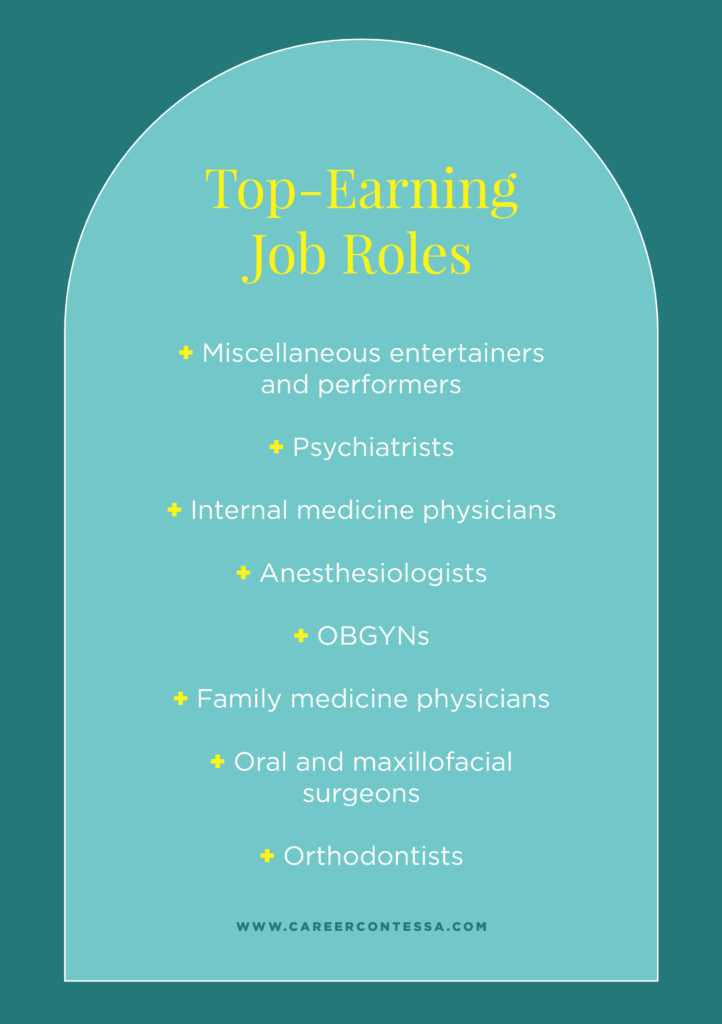

If you’re curious, the Bureau of Labor Statistics lists these roles as the top earners:

- Miscellaneous entertainers and performers

- Psychiatrists

- Internal medicine physicians

- Anesthesiologists

- OBGYNs

- Family medicine physicians

- Oral and maxillofacial surgeons

- Orthodontists

2. Salary + Location

Of course, your location has a lot to do with your salary. Using a cost-of-living calculator can help you determine what your lifestyle might cost in one city or area versus another.

Rent, parking, childcare costs, groceries, eating out—the cost of each of these things can vary depending on where you live. That average national salary of $58,260 will get you a lot farther in small-town Tennessee than it will in an expensive city, like New York or San Francisco.

Perhaps unsurprisingly, some states have higher average salaries than others. Take a look at your state’s data. According to this chart from ZipRecruiter, these states have the highest average salaries:

- Massachusetts

- Hawaii

- Rhode Island

- North Dakota

- Alaska

- Nevada

- Washington

- South Dakota

- New York

- Oregon

And these states have the lowest average salaries:

- Florida

- New Mexico

- North Carolina

- Alabama

- Iowa

- Georgia

- Louisiana

- Utah

- Ohio

- Wisconsin

3. Experience + Education

Your education, skills, and experience level matter, too, when it comes to deciding on a good salary. This helpful chart from Intuit shows how much education plays a role in your earnings. The average earnings for workers with a high school diploma are $38,792, while the average for college graduates with a master’s degree is $77,844.

Again, these numbers depend on the specific role and industry, but generally speaking, the more educated you are, the more you can expect to make. There are (unfortunately) exceptions to this (I see you, teachers).

More Education = Higher Salary*

*Statistically speaking, this is usually true.

Indeed’s analysts note that the more education you have, the higher your salary will be as well:

- People with a doctorate degree generally make 23% more than those with a master’s degree

- People with a master’s degree make 29% more than those with a bachelor’s degree

A stipulation here is that those percentages don’t matter that much if your education costs a boatload of money. You’d be smart to consciously weigh the financial ramifications of the career you’re pursuing through graduate degrees.

The same article found the following in terms of experience and compensation:

- If you have two to five years of experience, you should make roughly 32% more than someone just starting out.

- If you have five years of experience, that number jumps to 36%.

- If you have ten years of experience, that will look like a 21% increase.

- If you have fifteen years of experience, you can tack on another 14%.

All of that to say, the longer you’re in the workforce, the more you should expect to make as a way to reflect the years you’ve spent working, learning, and growing.

If you’re a recent graduate or are just starting out, don’t be disheartened—while your salary during your first year or two may start out lower than your more experienced counterparts, you should work your way through your career and see higher compensation along the way. In the meantime, try to establish strong financial habits like creating savings accounts, staying out of debt inasmuch as possible, and establishing rational spending habits.

Those things will help carry that higher salary further as you increase your qualifications and continue to make more money.

4. Family + Lifestyle

This category might be the toughest to nail down, but the size of your family and your lifestyle choices also determine what makes an ideal salary for you.

If you have five children, the cost of groceries and childcare will undoubtedly be higher than if you have one. If you’re a single woman, your grocery bills might be smaller when compared to someone with a few dependents.

And not to mention lifestyle: we all have different preferences and thresholds for what we enjoy spending money on. A $250 purse to one person might feel like a major splurge, while it might feel like a run-of-the-mill expense to another.

Whatever your outlook, it’s important to consider what you spend money on—and what you want to spend money on—so that you can more accurately determine what a comfortable salary might be for you. This also includes savings goals, which we’ll discuss in more detail below.

Does a Bigger Salary = Bigger Happiness?

There’s no way around it: your salary is important. If you’ve ever stressed about finances, lived paycheck to paycheck, or are working on staying out of “the red” every month, you know what I mean. We think a “good” salary is one that allows you to:

- Pay all of your bills on time and with ease

- Save a significant amount for your future

- Splurge on a few “nice-to-have” things like a fancy dinner out with friends or a new bag or a trip

All of this to say: how much you make is not everything. Yes, it’s important, but it doesn’t determine your worth.

A study from University of Pennsylvania’s Wharton School shows that your income level can affect your happiness more than was previously thought.

This is because having more money means you can more easily manage in the case of a financial emergency, therefore decreasing stress. So, there’s a sense of control that a “good” salary brings.

Consider The “Good Enough Job”

That said, the amount you make is certainly not everything. Nothing matters more than your health, well-being, and contentment level.

If you are working at a job you hate in a toxic environment for 70 hours a week, that $100,000 paycheck just doesn’t hit the same way—and that kind of stress can be rough on your overall well being.

Rather, a “good enough” job—one that allows you to do meaningful work and make enough money to support yourself and your family, enjoy your life, and save for the future is probably more appealing…even if the pay is $85,000 instead of $100,000.

That’s where you’ll have to have a gut check and use your judgment to determine what really matters to you.

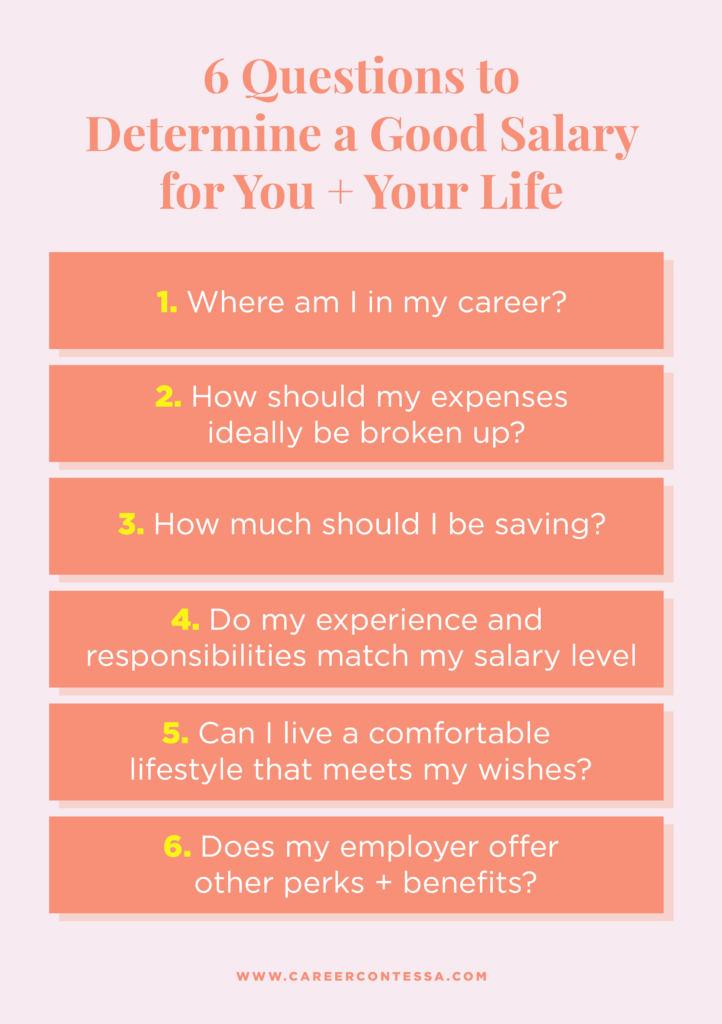

6 Questions to Ask to Determine a Good Salary for You

If you’re trying to determine just what that good salary would be for you, here are some questions to guide you as you calculate.

1. Where am I in my career?

It goes without saying that where you are in your career determines how much you’ll make. Having 15 years of experience on your resume, well, it literally pays.

If you’re just starting out after college and looking at an entry-level position, expect your salary to be less than it will be as you continue to grow and learn in your career.

Similarly, if you recently switched careers, you might be looking at a near entry-level paycheck again, despite having five years of experience in another industry.

The good news is that you can work toward promotions, upskill, and show how much of a valuable employee you are, and if your company is wise, they’ll compensate you fairly for that.

2. How should my expenses ideally be broken up?

We can’t really talk about a “good” salary without discussing your finances overall. This means you’ll need to break out a pen and paper or a clean Excel spreadsheet and get to calculating.

While sources vary, many agree with Nerdwallet’s recommendation of spending roughly 30% of your income on housing costs.

They also encourage the 50/30/20 rule, which means 50% of your take-home pay for your general needs and wants, 30% for housing, and 20% for savings.

Of course, you’ll also need to keep in mind how much debt you have and formulate a realistic plan to pay that down.

Need some resources to get your financial planning juices flowing? Here you go:

- How to Create a Budget and Financial Plan

- A 5-Step Guide to Adulting With Your Money

- The Financial Vocabulary Every Woman Needs

3. How much should I be saving?

Ah, the question of all financial questions. Experts vary in their responses to this, and it also depends on your age. Here are some average numbers we recommend for saving in your 20s, 30s, and 40s:

- 20s: Aim to put aside 10 to 20 percent of your paycheck into a retirement account each pay period.

- 30s: Aim to have about half to a year’s worth of your annual salary saved in your early 30s. This feels like a lot (and it is!), so don’t panic if you’re not there yet. The best thing to do is to start somewhere, even if it’s $10 here and there.

- 40s: Ally Bank recommends that you have three times your income saved by age 40. That’s also a lot, but take heart in the fact that your salary should grow as you continue to gain experience, and those percentage-based bonuses will get bigger as your base salary increases.

Need some savings inspiration? We gave some long-term tips here—and some “quick-hitter” tips here.

- 13 Unique Ways to Save Money Right Now

- The Envelope Challenge + 8 Fun Money-Saving Challenges to Start Today

- 9 Ways to Take Control of Your Budget

4. How do my experience and responsibilities match my salary level?

On this episode of the Career Contessa podcast, David Buckmaster gave some super helpful advice. He argued that it’s important to keep an eye on your company’s leveling guide, so that you can ensure that you are being fairly compensated.

This is especially helpful when you’re determining whether to ask for a raise: you can usually use that tool to see whether you’re performing duties that are “above your pay grade.”

Your experience—and the level at which you’re working—matter when it comes to your compensation. You may be able to leverage a higher salary based on the work you’re currently doing.

5. Can I live a comfortable lifestyle that meets my wishes?

This one’s personal. You may be entirely comfortable with a salary near the national median salary of about $58,000.

You may also feel like that’s not enough to live comfortably, especially if you live in a larger city or somewhere with a higher cost of living.

You’ll have to determine the ideal wage that allows you to live comfortably while easily paying your bills and ideally saving a decent amount for retirement.

6. Does my employer offer other perks + benefits?

In addition to monetary compensation, your employer’s benefits matter from a salary standpoint as well.

Even if your salary is $15,000 lower than you’d prefer, if you have a “good enough” job that provides flexibility and stability, in addition to great non-monetary compensation and perks, it might make up for the lower salary. These might include:

- Great health insurance coverage

- Strong paid leave + vacation

- Child care stipends

- Transportation stipends

- Tuition reimbursement and professional development opportunities

- Flexible, hybrid, or remote work opportunities

- Opportunity to earn lucrative bonuses

Eager to read more about salary and negotiation? We’ve written a lot about it over at Career Contessa. Check out these pieces:

World’s Best Hack: A Script To Ask For A Raise

Download our free raise script + learn:

Heads up! By downloading our script you’re agreeing to join our newsletter. You can unsubscribe at any time!